Crowdfunding is coming to Morocco soon. The deputies have begun examining a draft law that should provide a framework for crowdfunding. This new means of financing must be open to modest and connected savers.

Expected since April 2018, the examination of the so-called “collaborative financing” bill finally begins in Morocco. Technically, crowdfunding (“financing by the crowd”) is to bring together two needs through a platform on the internet. That of the entrepreneur/idea carrier who lacks liquidity and hopes to find financing and that of a saver who wants to invest a certain amount of money, in a project with detailed outlines. These are generally small businesses, but this law will also enable associations to raise funds to support their projects.

Under the banner of crowdfunding, the law provides three types of financing operations, each time via an electronic platform edited and managed by a collaborative financing company: project financing in the form of a loan (crowdlending, for which Bank Al Maghrib will control the interest rate or the maximum loan duration), a donation (crowdfunding strictly speaking: the donor will have to obtain an authorization if the amount exceeds MAD 500,000), or capital (crowd equity).

In the latter case, for managing companies that want to propose capital investment, a visa will have to be obtained from the Moroccan Capital Market Authority (AMMC). The platforms must have a minimum capital of MAD 300,000 and the collaborative finance companies that will manage them must have a policy of prevention and risk reduction.

The department and the government were structuring a segment that was going to be a must in any event. For several Moroccan project leaders have already made use of this means of financing, but through foreign platforms: “It is never good to let national projects be financed by international players. It was necessary to be active to allow Moroccan platforms to take over in a secure and transparent manner,” explains the Ministry of Finance. The State will be able to more directly control what is collected through this mode of financing.

The subject does not leave indifferent among the financial sphere, even if some doubt the qualification of parliamentarians on the subject: “It is a rather technical text and it takes a certain level to master everything. Unfortunately, I do not think that members of Parliament will be able to amend or improve it. Having said that, the initial text is good and it will allow us to see the emergence of this new segment that is very much in vogue throughout the world. We’re already way behind,” an investment banker told Jeune Afrique, who says he is able to quit his current job to launch a collaborative financing platform.

If the government approved it last August, after a long reflection started more than three years ago, the text of “Law No. 15.18 on collaborative financing” remained in the drawers of the secretariat of the parliament throughout this period, before being the subject of a first in front of the Finance and Economic Development Committee of the first chamber on Tuesday, December 24.

“The bill also aims to promote the release of the creative and cultural potential of young people and to strengthen the attractiveness and influence of Casablanca’s financial hub,” hoped Mustapha El Khalfi, former minister delegate in charge of relations with Parliament and civil society.

The law requires that collaborative finance companies will be able to identify the origin and destination of funds. Each collaborative finance company will have to appoint one or more auditors responsible for controlling and monitoring the accounts of its activities.

Between the passing of the law and the first creation of companies and platforms, there should still be a long time to go. Financial sector players will have to popularize this new means of financing among project owners and the general public who will be called upon to invest in it. The professionals of the financed sector contacted and the parliamentarians say they are confident in the rise of crowdfunding in Morocco.

Banks are very reluctant to finance small projects; bankers themselves are not trained to support small structures. Like the banks, venture capitalists are also not very keen on new projects and generally prefer to get on the train.

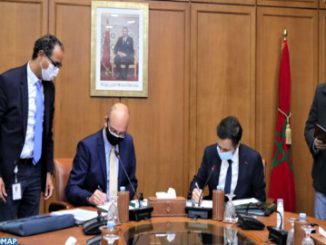

Several bankers, teams from the Central Bank and members of the American embassy in Morocco participated in the creation of this law. Then, the Ministry of Finance ensured that there was overall coherence, a senior official in the department headed by Mohamed Benchaâboun told Jeune Afrique.

Be the first to comment