In a monetary context marked by foreign exchange surpluses of about 671 million dollars on the market, national banks are having difficulty investing them. In fact, these currency investments are not advantageous to them, given the very low rates and the abundance of liquidity.

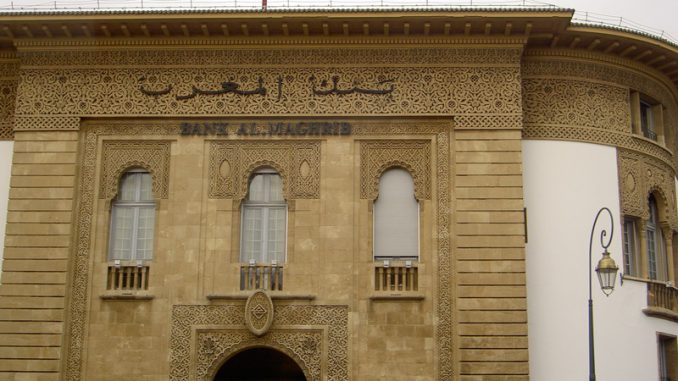

This is what pushed Bank Al Maghrib to buy them from these banks, by operating, in particular, since September 20, 2020, auctions of purchase of currencies in order to absorb the current surpluses and thus ensure the smooth functioning of this market.

The central bank has, moreover, specified that these auctions will be organized as much as necessary and this, according to the evolution of the conditions on the exchange market. If there is currently a surplus on the foreign exchange market, it is because in recent months, foreign exchange receipts are higher than foreign exchange expenditures. For some experts, “this surplus is partly explained by the recovery of tourism”.

But it is a rather cyclical situation which generally occurs in summer. There are the MREs and foreign tourists who come en masse and at the same time, there is a drop in economic activity over the period and therefore a drop in imports. This produces revenues that are higher than foreign currency expenditure,” they point out.

Such a surplus of foreign currency held by Moroccan banks can be invested in various instruments, including Treasury bills for example. This can only increase their foreign exchange positions. These modalities of currency investment are, moreover, dictated by Bank Al Maghrib.

However, currently the rates are not advantageous for the banks. And the banks of the place are not interested in proceeding in this way. To remedy this situation, Bank Al Maghrib has decided to absorb these currencies and to bear the cost. In the end, in an already saturated market, Moroccan banks have no interest in investing their surplus currency, while waiting for better days.

Be the first to comment